Money advice

Money advice can reduce the stress and anxiety that money worries can bring and help you to achieve your financial goals.

It can also help you make sure you are receiving all the benefits and financial support you could be entitled to and set a manageable budget keeping costs down. If you have debts, money advice can help you consider the options available to you to resolve your debts in a realistic time.

On this page:

Where to get money advice

Local advice organisations

Fee free basic bank accounts

Loan sharks

Help with Council Tax

Fraud

Further information

Where to get money advice

If you want to help yourself to maximise your income and manage your bills, all the national organisation have self-help material for you to work through a wide range of common issues. If debt is affecting your housing then contact the Housing Advice Team.

If you feel that you need some additional support to work through your options, you can contact one of the organisations below.

Reading Borough Council has a Money Advice Team who can help you to work out the best people to speak to about your situation. They also have resources to help you manage your money including the Money Advice Handbook that is full of practical advice.

National advice organisations

Self-help – when you are confident to help yourself:

- Citizens Advice – budgeting, benefits, housing, employment, immigration, debt options and many other topics

- National Debtline – advice on budgeting, benefits, housing, employment and debt options

- Money Helper – advice on budgeting, benefits, housing, employment and debt options

- Debt Advice Foundation – advice on budgeting, benefits, and debt options

- Shelter – advice on budgeting, benefits, housing and debt options

Assisted self-help – when you need a little extra support:

- PayPlan – budgeting, benefits and debt options

- StepChange – budgeting, benefits and debt options

Local advice organisations

Self-help – when you are confident to help yourself:

- RBC Money Advice Team – debt advice handbook, advice on budgeting, benefits, housing, debt options and template letters

Assisted self-help – when you need a little extra support:

- RBC Money Advice Team – advice on budgeting, benefits, housing, employment and debt options (available to council tenants, people affected by the benefit cap or at risk of losing their home)

- Reading Frontline – budgeting, benefits and debt options

- Christians Against Poverty – budgeting, benefits and debt options

Advice for students:

- Reading University Students Union – free, confidential and independent advice for all students

Fee-free basic bank accounts

To stay in control of your money, you need an account that is you can access your money and savings. You might want to open a basic bank account with a bank you do not owe money to if:

- You are overdrawn and being charged fees, reducing the money you have access to when it comes into your account.

- Owe money to your bank, banks can use the ‘right of set-off’ to take money you owe them for debts from your account.

- If your current bank or building society doesn’t allow you to set up a Standing Order or a Direct Debit to make it easier to pay bills and manage your money

You can open a basic bank account if you have a poor credit rating or struggling to open a standard current account.

For more information visit our Fee-free basic bank accounts website or the Money Helper website.

Borrowing money

If you are struggling, borrowing money to repay debts can seem like a good idea, but can easily make your situation worse. You are not alone, help and support is available to you anytime.

Money Helper provides free, impartial guidance that’s backed by government. They have an online tool that will show the different credit options available to you and the pros and cons to help you make an informed decision. If you are not sure what to do, get advice.

Credit Unions and Community Banks

Boom Community Bank is like a high street bank in that it lends to borrowers, looks after money for savers and provides current accounts; however, it does not operate to make a profit. Boom’s purpose is to help its customers build financial resilience by providing accessible financial services with an emphasis on regular savings, even for those who borrow. Boom Community Bank pledges fair, transparent loan pricing and is committed to responsible lending principles. Visit Boom’s website for more information on loans, savings, and current accounts.

- Email: info@boomcb.org.uk

- Website: www.boomcb.org.uk

- Telephone: 01903 237221

London Capital Credit Union – A not for profit savings and loans co-operative, visit their website for details of who can open an account.

Help available from the Department for Works and Pensions

Budgeting Loan

If you are receiving one of the following, you can apply for a Budgeting Loan:

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Pension Credit (if you have moved from Universal Credit, the time you claimed Universal Credit counts towards the 6 months)

It can be used for essential living costs. It is interest free and repaid through your benefits, if you stop receiving benefits before the loan is paid, you will need to make an arrangement to repay it.

For more information visit Gov.uk

Advance Payment

If you are receiving Universal Credit and need help to pay your bills until your first payment or receive Universal Credit and had a change of circumstances that will increase your award that you have not been paid yet, you can apply for an Advance Payment. The advance will be repaid through deductions from your Universal Credit award at a rate agreed with you when you apply, if you stop receiving Universal Credit before the advance is paid, you will need to make an arrangement to repay it.

For more information visit the gov.uk advance payments and Gov.uk – budgeting help.

Budgeting Advance

If you are receiving Universal Credit, you can apply for a Budgeting Advance to help with emergency household costs if you meet the eligibility criteria.

It is interest free and repaid through your benefits, if you stop receiving benefits before the loan is paid, you will need to make an arrangement to repay it.

For more information visit Gov.uk.

Hardship Payment

Universal Credit sanctions reduce the Standard Allowance element of your Universal Credit award, you still receive your other elements (like the Housing Costs Element) but you will receive less Universal Credit.

If you do not complete the actions agreed in your claimant commitment, you might be sanctioned. Before you apply for a hardship payment, you will need to do the actions that you were supposed to do to be eligible.

You can apply for a Hardship Payment by calling the Universal Credit helpline on 0800 328 5644. It is a loan, so you will need to repay it when your sanction is removed.

For more information visit the Citizens Advice website. You will also need to reapply every month you need a hardship payment.

Loan sharks

A money lender must be authorised by the Financial Conduct Authority (FCA) to lend money legally. An unauthorised lender does not have the legal right to recover the debt as it is illegal.

If anyone you have borrowed money from threatens you or is violent, contact the police straight away.

How to spot a loan shark

- Little or no paperwork to confirm the repayment arrangements or how much you owe

- Very high rates of interest charged

- You might not be allowed to pay the debt in full

- Lends money to lots of people

- Threatens violence if you fall behind

- Valuable items taken from you as security

- You can report loan sharks on 0300 555 2222

Reporting a loan shark

Contact the Illegal Money Lending Team on 0300 555 2222, you do not need to give them your details unless you feel comfortable. They provide specialist support, help and advice for victims of loan sharks. Stop Loan Sharks website

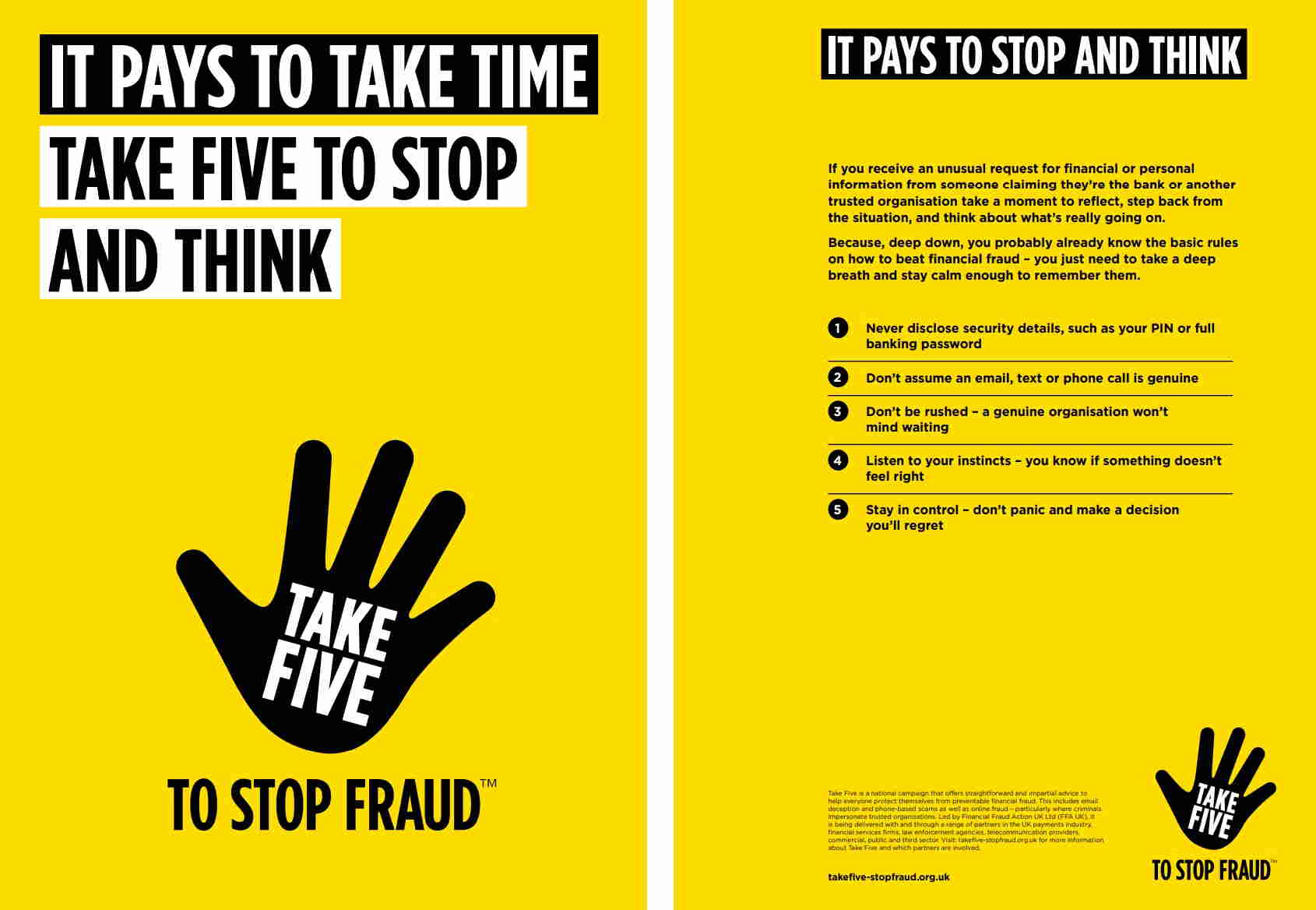

Fraud

Visit Take Five to Stop Fraud for information on the national campaign that offers straightforward and impartial advice to help everyone protect themselves from preventable financial fraud.

If you are concerned about something or want some advice or support before you take action you can contact Action Fraud on 0300 123 2040 or visit Action Fraud.

Reading Borough Council Trading Standards is responsible for maintaining the fairness of the trading environment in Reading by protecting the interests of consumers and reputable traders.

Help with Council Tax

See what help is available if you are struggling to pay your Council Tax bill.

Further information

There are many websites with simple and useful guides and information on how to ease the squeeze caused by the rise in the cost of living:

- Money Helper – advice and tools from the money & pensions service.

- Citizens Advice – advice on a range of issues including reducing your regular living costs.

- StepChange – advice on how to cope with the rising cost of living.

- Money Saving Expert – information on a range of money saving advice and tips.